Slovakia SAP E-Invoicing Solution

Slovakia is entering a new digital era of invoicing with the mandatory e-invoicing system (IS EFA) effective from January 2027. Our SAP integrated solution ensures seamless compliance with Slovak legislation, Peppol standards, and EN 16931, making it easier for public authorities, suppliers, and businesses to create, validate, and securely transmit electronic invoices.

Get ready for Slovakia’s mandatory e-invoicing starting January 2027.

SAP E-Invoicing Solution for Slovakia

Quick Implementation

With Melasoft, your SAP system achieves full Peppol and IS EFA compliance in just 2 weeks. Direct integration into SAP ECC and S/4HANA, with no middleware required.

Compliance & Security

The solution is fully compliant with Slovak legislation, Peppol, and EN 16931. Ensures the secure creation, validation, and transmission of electronic invoices (XML UBL/CII).

AI-Powered Automation & Efficiency

Integrated B2B e-invoicing, automated VAT reporting, and data validation. This reduces manual tasks (AP/AR), ensures error detection, and provides seamless ERP integration.

Get in touch by filling out the form.

We’ll respond as soon we can.

Talk to Our Sales Team in Your Language

.png)

Mohammed Bouhaba

SAP Sales

Consultant

Languages Spoken

Srdan Thian

Senior Sales

Representative

Languages Spoken

Moritz Junker

Automation & E-Compliance

Consultant

Languages Spoken

Emil Momberg

Partnertship

Consultant

Languages Spoken

Süleyman Çelik

Chief Executive

Officer

Languages Spoken

Who Needs to Comply?

Public authorities: Required to accept e-invoices

Suppliers to public sector: All VAT-registered businesses providing goods/services to government entities

B2B companies: Currently voluntary, but mandatory from 2027

Foreign suppliers: Invoices submitted via dedicated government channels

Technical Requirements Invoice format

XML (UBL 2.1 or CII D16B) Transmission: IS EFA portal (manual upload or API integration)

Authentication: Qualified Electronic Signature (QES) or Seal Archiving: Minimum of 10 years

E-Invoicing in Slovakia

Slovakia is moving towards mandatory electronic invoicing with full implementation effective January 1, 2027.

The initiative, led by the Ministry of Finance and aligned with EU Directive 2014/55/EU, aims to:

-

Increase tax transparency

-

Reduce fraud and errors

-

Enhance efficiency for both businesses and public authorities

Currently, Business-to-Government (B2G) e-invoicing is in place for invoices above €5,000. By 2027, the mandate will expand to B2B and B2C transactions.

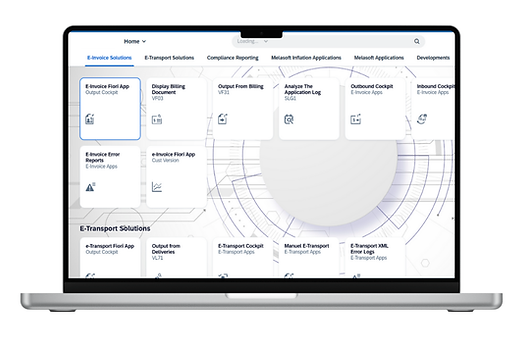

Melasoft SAP E-Invoicing Solution for Slovakia

Melasoft delivers a comprehensive SAP Add-On and Portal Solution tailored for Slovak e-invoicing:

-

Direct SAP integration with IS EFA

-

Peppol-ready gateway ensuring EN 16931 compliance

-

Automated validation & reporting to reduce compliance risks

-

Scalable cloud-based solution for high transaction volumes

-

Long-term secure archiving aligned with Slovak legal requirements

Ensure compliance and future-proof your business with Melasoft’s Slovakia e-Invoicing Solution.