SAF-T Process in Norway

- Melasoft

- May 29, 2022

- 4 min read

Updated: Jan 31, 2025

A Brief Overview of the Norwegian SAF-T

The Norwegian SAF-T process came into effect for the first period with financial reporting after 1 January 2020. Before this date, the use of SAF-T was voluntary.

Norwegian SAF-T (Standard Audit File — Tax) is a standard file format for exporting various types of accounting transactional data using the XML format.

SAF-T is a standard format created for the exchange of accounting data. The standard is the result of joint development cooperation between business, the accounting sector and the Norwegian Tax Administration, based on a recommendation by the OECD. This standard specifies which accounting data will be exchanged, as well as the nature of the data used.

With SAF-T, it will be easier to submit accounting records to official authorities for businesses that have a bookkeeping obligation. It will also be easier to conduct internal audits in companies, analyze data in special systems, and share data with others. In addition, it will be easier to change the accounting system and integrate different systems. SAF-T is the new way of collecting accounting data for the Norwegian Tax Authority, meaning automation and less manual processes. This means more efficient inspections and shorter case handling times.

Who should be able to produce accounting data in SAF-T format?

his requirement will apply to all businesses with bookkeeping obligations that use electronic accounting systems. Businesses with a turnover of less than 5 million NOK (ca. 480 K Euros) are exempt from the requirement. However, if these businesses have accounting information available in electronic form, the requirement will apply to them. It is system suppliers who need to adapt their accounting systems so that systems can meet the new standard on-demand. Businesses with bookkeeping obligations that have fewer than 600 vouchers per year and keep their accounts in a text editor or spreadsheet programs are not included in the requirement as these systems count as manual solutions and not an electronic accounting system.

SAF-T report and One voucher

Using the One voucher functionality introduces a limitation of further SAF-T reporting for data if one voucher was applied. We recommend that you set the Allow multiple transactions within one voucher parameter on the General ledger parameters page to No in your legal entity if you post transactions that are part of the SAF-T report.

What is One voucher?

The existing functionality for financial journals (the general journal, fixed asset journal, vendor payment journal, and so on) lets you enter multiple sub-ledger transactions (customer, vendor, fixed assets, project, and bank) in the context of a single voucher. Microsoft refers to this functionality as One voucher. You can create a single voucher by using one of the following methods:

Set up the journal name (General ledger > Journal setup > Journal names) so that the New voucher field is set to One voucher number only. Every line that you add to the journal is now included in the same voucher. Therefore, the voucher can be entered as a multiline voucher, as an account/offset account on the same line, or as a combination.

On the other hand, SAF-T does not replace tax return reporting. Accounting information in SAF-T format is submitted to the tax office in connection with the tax audit when requested by a tax auditor.

SAF-T Usage and Transmission

As long as a business has bookkeeping information in electronic format, it must display recorded information in SAF-T format. This means banks must use the format in the same way as other businesses that need to keep accounts. Public sector companies are also subject to this requirement if they have bookkeeping obligations.

Uploading via Altinn is the main method of sending SAF-T files. For large files over 200MB (up to 2GB in zip files), the relevant case handler at the Norwegian Tax Administration should be contacted.

SAF-T and VAT Rate

NTA has solved the problem by using BaseRate when calculating proportional deductions for VAT. The use of the BaseRate is critical for most industries where several different percentages are used. However, some industries, including the real estate development industry, often use many different percentages throughout the year. In addition, proportional VAT deductions are also recorded in the accounts as the accounts are written to the SAF-T file. The method a business uses to post proportional deductions for VAT in its accounts is deemed to meet current legal requirements. While SAF-T Norway reports and the new e-VAT return reporting are independent of other country regimes, they are based on the same standard VAT codes and must be consistent.

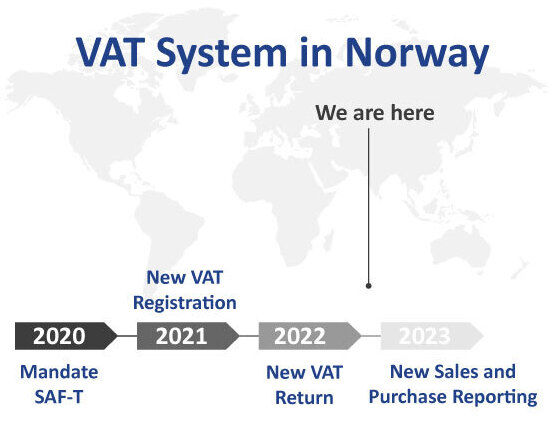

Modernization of Norwegian VAT systems

Modernization work began in 2019, as the VAT law, which has remained more or less unchanged since 1970 and based on manual business processes, gave some companies an illegal competitive advantage over others and resulted in revenue losses for the Norwegian government. The modernization process carried out by NTA is planned to be completed by the end of 2023.

The main objectives of the Norwegian VAT System are:

Increasing compliance with rules on taxes and fees

Reducing the scope of the hidden economy

Convenience for business in VAT-related tasks

How does the Melasoft SAF-T Solution help?

The Melasoft solution extracts periodic accounting and VAT data from your SAP data and issues an electronic SAF-T document within the customer’s SAP. In this way, your auditing and digital reporting processes become faster and easier.

Comments